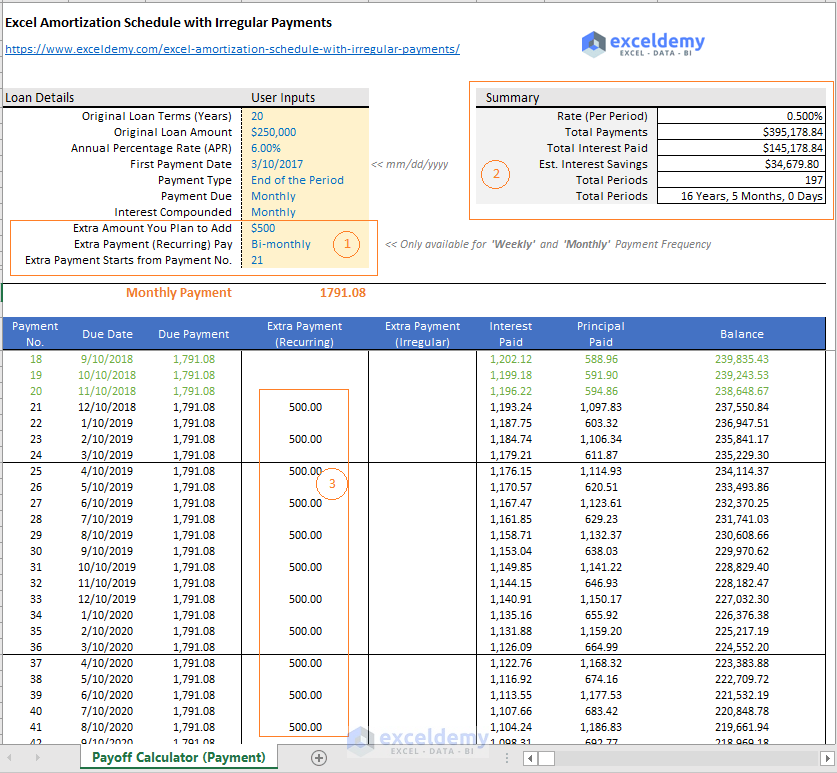

We divided it by 12 to find on monthly basis. The difference between Purchase Price and Down Payment is a payment which is used in Amortization Schedule and can be find on Amount Financed cell of Data Entry Area. In Data Entry Area, Purchase Price, Down Payment, Annual Interest Rate, Term and Loan Date information subject to changes. Some Excel functions including Sequence, EDate, PMT have been used in this template. I have used some icons and pictures from different sources which have been written on template. These payments are applied to the Principal Amount. Each cell extracts Interest Rate from top cell.Īdditional payments are entered in the Additional Payment Column. If the interest rate changes, the user can enter the new rate in Annual Interest Rate Column. Two columns (Annual Interest Rate and Additional Payment) have been added to the Table. This Dynamic Amortization Schedule is built on the Static Amortization Schedule example. Amortization refers to the process of paying off a debt over time through regular payments. Weighted average cost of capital (wacc)įinancial statement loan amortization loan amortization schedules pmt dynamic amortizationĪn amortization schedule is a table detailing each periodic payment on an amortizing loan, as generated by an amortization calculator.International financial reporting standards (ifrs).

0 kommentar(er)

0 kommentar(er)